Website builders are SaaS solutions that make it easy for users to build stunning websites with no coding knowledge required.

There are lots of website building platforms out there—but which is the most popular?

In this post, we’ll explore that question as we look at website builder market share distribution.

First, we’ll reveal which website builder has the greatest market share this year. Then, we’ll take a deep dive into all the data about the market leaders.

Ready? Let’s jump into it!

Quick note before we get started: WordPress is the most popular software used to build and manage websites. However, we won’t be including it in this analysis because WordPress is technically a CMS (content management system) rather than a dedicated website builder. If you want to see how WordPress factors into the data, see our CMS market share post.

What is the most popular website builder?

Wix is the most popular website builder, with over 45% of the market share.

It’s used on over 8 million live websites across the internet, which is 3x more than its nearest competitor, Squarespace. This is according to data from BuiltWith.

Bear in mind that we’re only talking about dedicated, general-purpose website builders here. We haven’t factored in ecommerce platforms like Shopify or CMS software like WordPress (yet).

Growth of Wix market share over time

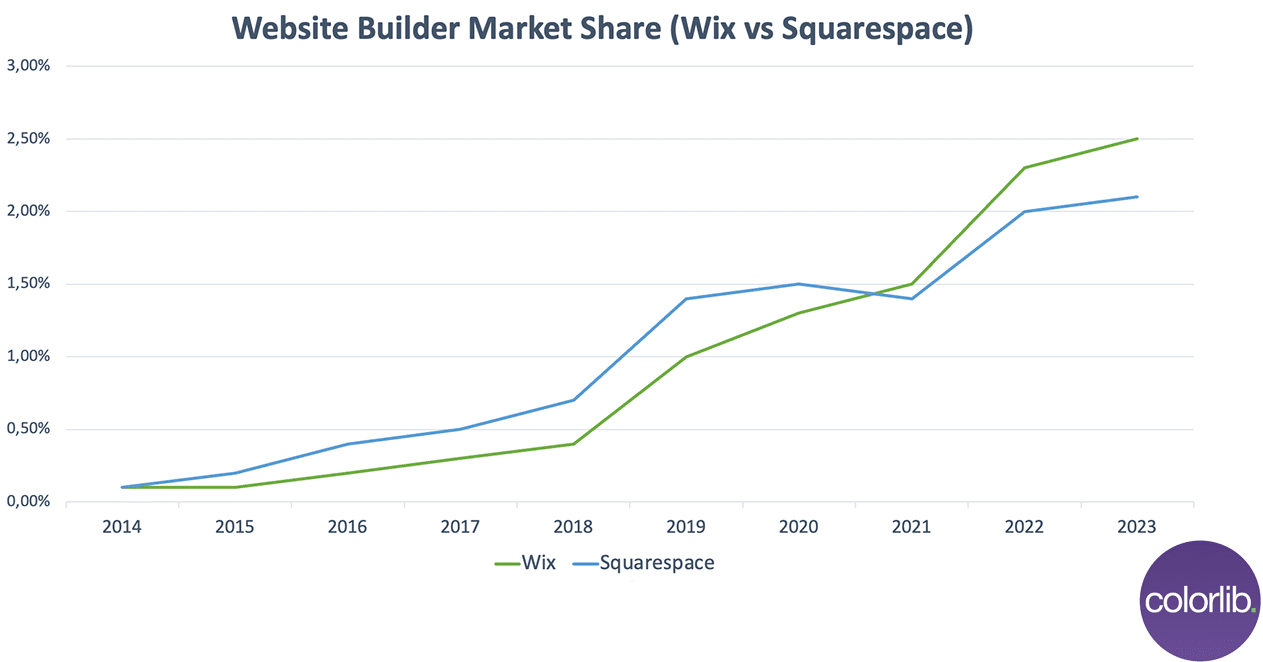

Interestingly, Wix wasn’t always the number one website builder by market share. A few years ago, that title would have gone to Squarespace. But Wix has grown rapidly over the last few years and outpaced its biggest rival.

The table below that illustrates the growth of Wix over time compared to Squarespace, based on data from W3Tech.

Website builder usage by year (% of total websites):

| Year | Wix | Squarespace |

| 2023 | 2.5% | 2.1% |

| 2022 | 2.3% | 2% |

| 2021 | 1.5% | 1.4% |

| 2020 | 1.3% | 1.5% |

| 2019 | 1% | 1.4% |

| 2018 | 0.4% | 0.7% |

| 2017 | 0.3% | 0.5% |

| 2016 | 0.2% | 0.4% |

| 2015 | 0.1% | 0.2% |

| 2014 | 0.1% | 0.1% |

| 2013 | <0.1% | <0.1% |

*This figure represents the % of the top 10 million websites on the internet that are powered by each website builder. It’s not the same as their market share within the website builder sector.

And if we plot that data on a graph, you can clearly see the trajectory:

As you can see, 2021 was really the turning point for Wix. Until then, Squarespace had been the market leader but over the last couple of years, Wix has gained thousands of new users and turned the tide.

Sources: BuiltWith1, W3Tech

How big is the website builder market?

The global website builder market is expected to reach around $1.8 billion USD as of 2022. And market forecasts project a CAGR of 6.9% from 2022-2032, putting it on track to surpass $3.5 billion over the next decade.

According to BuiltWith, around 18 million live websites use simple website builders, and around 23 million use hosted solutions (website builders + ecommerce platforms).

Sources: Globe Newswire, BuiltWith1, BuiltWith2

Website builder market share

Next, let’s take a closer look at the top website builders by market share.

We’ll be using data from BuiltWith for the bulk of this analysis (this is the most authoritative data source we could find), but we’ll also briefly compare it to data from Datanyze for a broad overview.

Entire internet

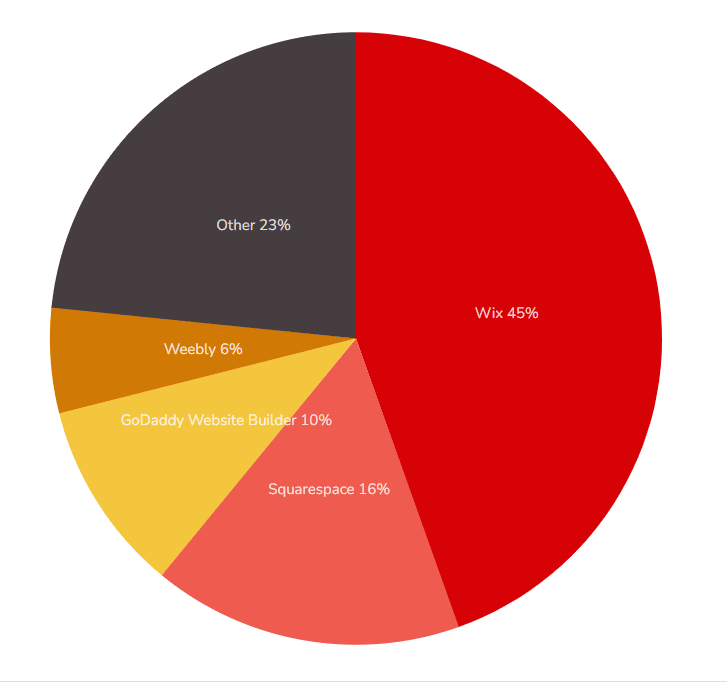

Around 18 million websites on the internet use simple website builders. The table and graph below represent the simple website builder market share in this data set:

| Website builder | Market share (approx. %) | Number of websites (approx.) |

| Wix | 45% | 8 million |

| Squarespace | 16% | 2.9 million |

| GoCentral (GoDaddy) | 10% | 1.8 million |

| Weebly | 6% | 1 million |

| Jimdo | <3% | 470,000 |

| Other | 23% | 4.2 million |

As you can see, the top 3 website builders by market share are Wix (45%), Squarespace (16%), and GoCentral (GoDaddy Website Builder) (10%).

GoCentral is a surprising appearance here as it’s a relatively new tool. GoDaddy is best known as a web hosting provider, rather than a website building SaaS provider. However, they recently expanded their service offering to include the site building software and, as this stat shows, it seems to have been a success.

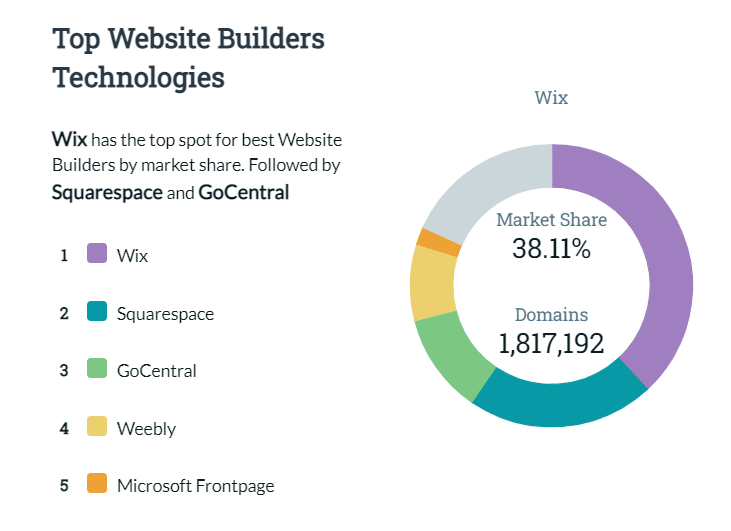

Datanyze also provides data on the market share of the website builders software industry. Their market share analysis is based on a smaller data set of 2.95 million company websites but nonetheless shows similar results to BuiltWith.

Here’s the website builder software market share according to Datanyze:

| Website builder | Market share (approx. %) | Number of websites (approx.) |

| Wix | 38% | 1.8 million |

| Squarespace | 21% | 1 million |

| GoCentral | 11% | 550k |

| Weebly | 9% | 420k |

| Microsoft Frontpage | 2% | 100k |

| Other | 18% | 870k |

As you can see, the top 4 website builders according to Datanyze are identical to those in BuiltWith’s analysis. The main difference is in the numbers: Datanyze puts the gap between Wix and Squarespace much lower. It also ranks Microsoft Frontpage ahead of Jimdo in the #5 spot.

Top 1 million sites

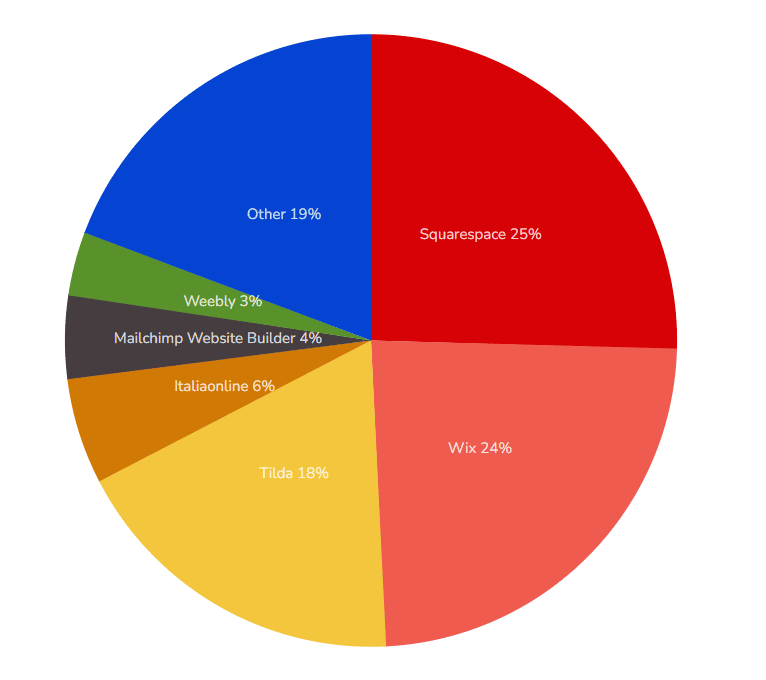

So far, we’ve looked at website builder market share across the internet. Now let’s take a look at market share distribution amongst high-traffic sites.

Here’s what the market share looks like across the top 1 million websites by traffic:

| Website builder | Market share (approx. %) |

| Squarespace | 25% |

| Wix | 24% |

| Tilda | 18% |

| Italiaonline | 6% |

| Mailchimp website builder | 4% |

| Weebly | 3% |

| Other | 19% |

Top 100k websites

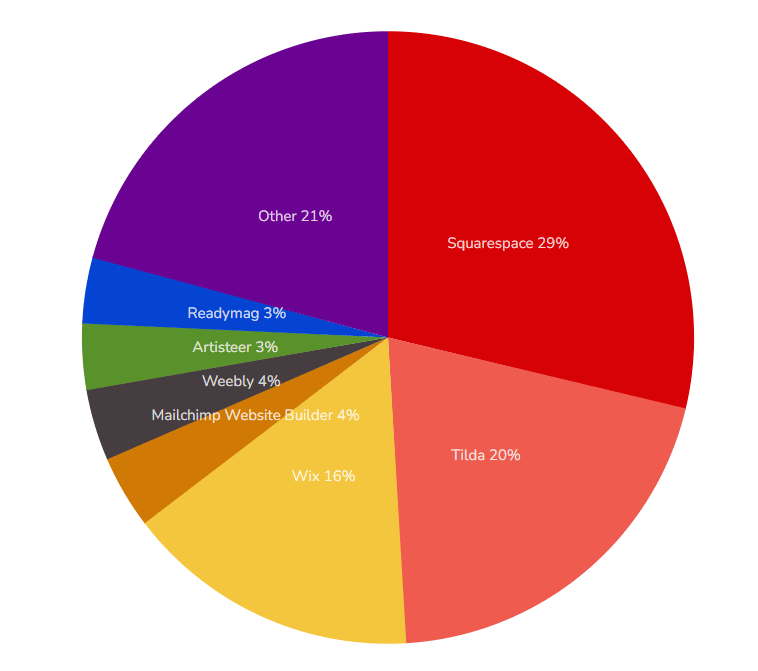

This is what the market share looks like across the top 100k websites by traffic:

| Website builder | Market share (approx. %) |

| Squarespace | 29% |

| Tilda | 20% |

| Wix | 16% |

| Mailchimp website builder | 4% |

| Weebly | 4% |

| Other | 21% |

Top 10k websites

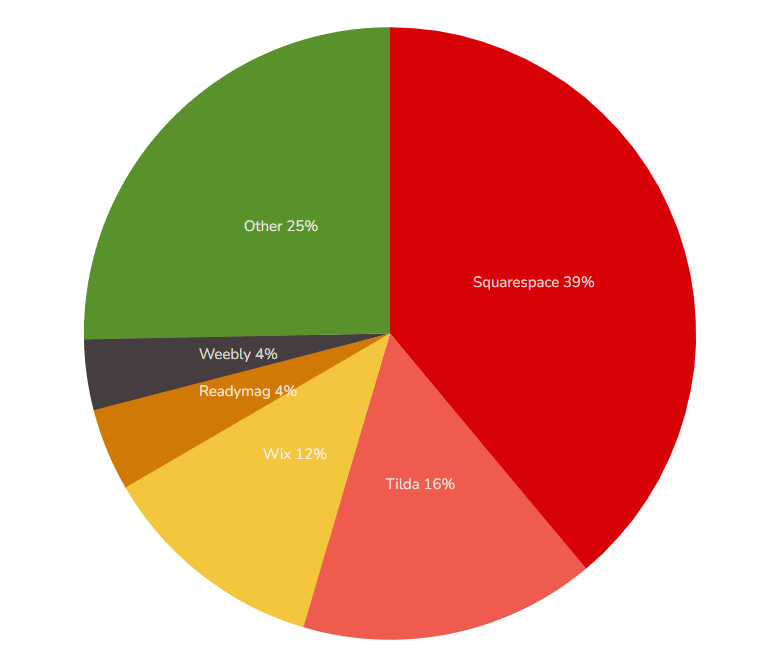

And this is what the market share looks like amongst the top 10k websites by traffic:

| Website builder | Market share (approx. %) |

| Squarespace | 39% |

| Tilda | 16% |

| Wix | 12% |

| Weebly | 4% |

| Readymag | 4% |

| Other | 25% |

As you can see from these statistics, Wix’s market share seems to inversely correlate with website traffic. The more traffic a website gets, the less likely it is to use Wix.

Conversely, Squarespace’s market share goes up alongside website traffic. It’s the market leader amongst the top websites, with a market share of 25% in the top 1m sites, 29% in the top 100k sites, and 39% in the top 100k sites. This is more than Wix on all accounts.

Tilda is also used more often than Wix in the top 100k and top 10k websites.

Sources: BuiltWith1, Datanyze

Website builder market share (including ecommerce)

Before we wrap up, we want to share one more data set.

So far, we’ve looked at the distribution market share amongst general-purpose website builders. These are the platforms that you can use to build content-driven websites.

But we haven’t factored in ecommerce platforms.

Ecommerce platforms are a specific type of hosted website builder that help you to build websites through which you sell products and services. On top of the core website building features, ecommerce platforms typically include additional commerce-focused features like an integrated checkout, payment gateway integration, order and product management tools, etc.

If we include ecommerce platforms in the website builder market share data, here’s what the distribution looks like:

| Hosted solution | Market share (approx. %) |

| Shopify | 32% |

| Wix | 10% |

| Squarespace | 10% |

| Wix Stores | 7% |

| Tilda | 7% |

| Contentful | 7% |

| Shopify Plus | 5% |

| Other | 22% |

*These numbers are based on BuiltWith’s Hosted Solution distribution for the top 1 million websites.

As you can see, Shopify dominates the market with almost a third of the market share. This is more than both Wix and Wix Stores (the platform’s ecommerce offering) combined.

This matches up to data from W3Tech, which shows Shopify is the second most popular CMS after WordPress, while Wix is the third.

Source: BuiltWith2, W3Tech

Final thoughts

That concludes our in-depth guide to website builder market share. We hope you found these statistics useful!

The key takeaway is that Wix is the current market leader and has successfully established itself as the dominant player in the simple website builder sector.

However, it still can’t compete with Shopify in the ecommerce sector, which suggests Wix may want to focus on improving and expanding its ecommerce plans if it wants to continue to grow.

Want to learn more? Don’t forget to check out some of our other statistics posts while you’re here.

Enjoy!

Was this article helpful?

YesNo