In this article, we’ll expose the latest SaaS statistics and share with you how many SaaS companies are there globally.

Software as a Service is revolutionizing how businesses operate, making managing and maintaining everything cost-effectively, with lots of flexibility and adaptability.

New and existing companies are adopting SaaS as one of their critical components in taking things to the next level.

So whether you’re a business owner or a software developer (even someone simply interested in tech trends), these SaaS statistics will surely provide lots of valuable insights into this rapidly growing field.

This post covers:

SaaS Statistics (Our Top Picks)

- There are nearly 31,000+ SaaS companies globally

- The US alone has 17,000 SaaS companies

- Global SaaS market is expected to be worth almost $900 billion by 2030

- Germany is expected to grow the most in SaaS business in Europe

- The average organization uses 110 SaaS apps

- Sales and marketing are SaaS companies’ biggest expenses

- Adobe spent $130 million on Google Ads in 2022

- By 2025, 85% of business apps will be SaaS-based

- Only 14% of organizations monitor their SaaS security settings daily

How Many SaaS Companies Are There?

1. There are approximately 30,800+ SaaS companies globally

The report by Statista shows that there are around 30,800+ SaaS companies around the world, with the most in the United States.

Some of the largest ones in the US are Google Workplace, HubSpot, Slack, GitHub, Zoom and Figma, to name a few. Two-thirds of the top 100 companies are located in the Silicon Valley. Also, out of all those 30K+ companies, 337 are unicorns and 15 are decacorns.

However, Ascendix predicts a massive jump to 72,000 SaaS companies by 2024. And if we include all the AI companies in the world, the number would increase to a whopping 175,000.

2. The US alone has 17,000 SaaS companies

As mentioned earlier, the United States has the largest share of SaaS companies in the world, approximately 17,000. And these 17K organizations had around 59 million customers globally. The UK and Canada have 2,000 companies in second place, and Germany and France, with 1,000 companies in third place.

| Country | Number of SaaS companies |

| United States | 17,000 |

| United Kingdom | 2,000 |

| Canada | 2,000 |

| Germany | 1,000 |

| France | 1,000 |

| India | 994 |

| China | 702 |

| Brazil | 647 |

| Australia | 631 |

| Spain | 511 |

Source: Statista

3. Most SaaS companies are in the Customer Service Solutions segment

There are 17,000 SaaS companies (like Salesforce) in the Customer Service Solutions segment, followed by Marketing Software (15,000), eCommerce (14,000), Data and Analytics (12,000) and Sales (11,000).

Source: Ascendix

4. 344 new SaaS organizations launched in 2022

In the last year, there were 344 new SaaS organizations, of which 334 were for-profit and the rest non-profit. (In fact, data shows that only five were non-profit – so we’re unsure in which bucket the remaining few go.)

One of the most significant spikes in new SaaS companies being founded was in 2015 and 2017, with 1,469 and 1,460 new SaaS businesses.

Fun fact: The trend of newly started SaaS companies dropped in 2018, 2019 and 2020.

Source: Crunchbase

SaaS Market Share

5. Global SaaS market is expected to be worth almost $900 billion by 2030

The global SaaS market was valued at $151.31 billion (or $167.34 if looking at Statista’s data) in 2022 and is expected to grow at 27.45% CAGR from 2023 to 2030.

According to Statista, the global SaaS market will be worth around $197 billion in 2023 and reach $232 billion in 2024.

| Year | SaaS market value |

| 2024 | $232.3 billion |

| 2023 | $198.29 billion |

| 2022 | $167.34 billion |

| 2021 | $146.33 billion |

| 2020 | $120.7 billion |

| 2019 | $102.1 billion |

| 2018 | $85.7 billion |

| 2017 | $58.8 billion |

| 2016 | $48.2 billion |

| 2015 | $31.4 billion |

Source: Verified Market Research, Statista

6. The US SaaS market is forecast to hit $135.1 billion in 2023

The Software as a Service segment is expected to grow to over $135 billion in 2023 in the US. But with an annual growth rate of 5.49% CAGR, it should be valued at around $167 billion by 2027.

When we look at the global market share, the United States will generate the most revenue.

Source: Statista

7. Germany is expected to grow the most in SaaS business in Europe

While the European SaaS market has been rising since 2020, Germany is expected to experience the most growth, from $7.56 billion in 2020 to nearly $18 billion in 2025. And it’s forecast to jump to $18.83 billion by 2027.

Source: Statista

8. SaaS market share prediction for 2027 around the world

Now let’s take a peek at the prediction of the value of the Software as a Service market share in other countries around the world.

| Country | SaaS market volume |

| China | $29.84 billion |

| United Kingdom | $17.39 billion |

| Japan | $14.82 billion |

| France | $10.7 billion |

| Canada | $8.47 billion |

| Australia | $6.23 billion |

| Sweden | $3.65 billion |

| Brazil | $3.17 billion |

| Spain | $2.43 billion |

| Mexico | $2.05 billion |

| Taiwan | $1.6 billion |

| New Zealand | $1.21 billion |

| Russia | $1.13 billion |

| Poland | $928.1 million |

| Ireland | $750.7 million |

Quick recap: The top five leading SaaS companies are the United States, China, Germany, the United Kingdom and Japan.

Source: Statista

9. SaaS beats other cloud services by end-user spending

The total global cloud adoption is increasing across all sectors, with SaaS leading the game.

| Cloud service | End-user spending |

| Cloud Application Services (SaaS) | $171,915 million |

| Cloud System Infrastructure Services (IaaS) | $121,620 million |

| Cloud Application Infrastructure Services (PaaS) | $100,636 million |

| Cloud Business Process Services (BPaaS) | $55,538 million |

| Cloud Management and Security Services | $29,736 million |

| Desktop as a Service (DaaS) | $2,710 million |

The total global public cloud service end-user spending was $313,853 million in 2020 and $396,147 million and 2021.

Gartner predicts that the total public cloud spending will surpass 45% of all enterprise IT spending by 2026.

Source: Gartner

SaaS Adoption Statistics

10. The SaaS market is growing by nearly 18% yearly

As we learned before, the SaaS market is growing the fastest in the cloud computing space, with a CAGR of 17.6% annually.

Speaking of which, have you seen our comprehensive cloud computing statistics?

Source: ReportLinker

11. The SaaS adoption in healthcare is growing at 20%/year

The healthcare industry is one of the most interested in adopting SaaS products and services, with a growing rate of 20% each year.

Source: BMC

12. Agility and scalability as two of the top reasons for using SaaS applications

70% of CIOs reported that agility and scalability are two of the biggest motivators when it comes to integrating SaaS applications into their businesses.

Source: LogicMonitor

13. 88% of organizations use at least one cloud service

Nearly 90% of organizations report using at least one cloud service in their organizations, but they expect to integrate more SaaS services in the coming year.

Source: O’Reilly

14. The average organization uses 110 SaaS apps

From 80 applications in 2020, the average number of SaaS apps adopted by organizations increased to 110 in 2021. When looking at historical data, that’s a nearly 7x increase since 2017 and a 14x increase since 2015.

Furthermore, it’s reported that one to two year old companies (considered young) start with around 29 SaaS applications. But they’ll have over one hundred apps when they’re six years old. After that, the number of apps in use decreases because of consolidation.

Source: BetterCloud #1, BetterCloud #2

15. 93% of SaaS-powered workplaces are SaaS-based

A SaaS-powered workplace is an organization that runs almost entirely on SaaS – such organization use, on average, 212 SaaS applications. However, most of workplaces are still in the transition phase, with more than half of their apps being SaaS-based. There’s only a small percentage of workplaces that use less than 10% SaaS apps.

Source: BetterCloud

16. 55%+ say lack of visibility into 3rd-party app access to the core SaaS stack is the main security concern

The main security concern when adopting SaaS apps worldwide for 56% of respondents is the lack of visibility into 3rd-party app access to the core SaaS stack. Moreover, 32% said their biggest concern is the lack of SaaS security.

Source: Statista

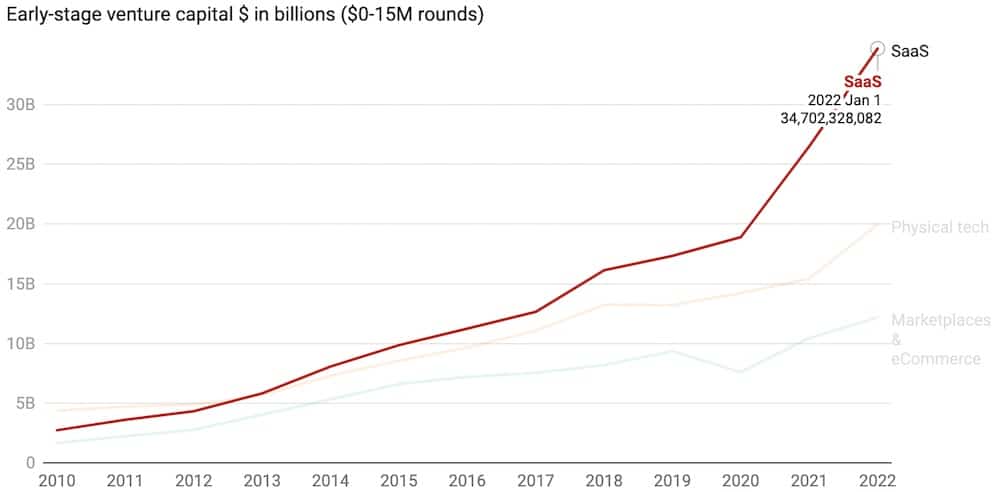

17. $34+ billion investment for early-stage SaaS companies

In 2022, early-stage SaaS companies received more than $34 billion in VC investments. As the graph above shows, that’s a significant and largest increase in history.

In the same year, physical tech and marketplaces and eCommerce received investments of $20 billion and $12 billion.

Source: Dealroom

18. Sales and marketing are SaaS companies’ biggest expenses

SaaS companies spend 50% (or more!) of their revenue on sales and marketing. The main reason for the high ratio is the result of the business model – revenue lags behind investment. And second is inefficiency.

Source: McKinsey

19. Microsoft had the largest SaaS market revenue share in 2021

With nearly 17% of the SaaS market share, Microsoft dominated the space in 2021, followed by two other big players, Salesforce and IBM.

| Year | Revenue |

| 2022 | $198.27 billion |

| 2021 | $168.09 billion |

| 2020 | $143.09 billion |

| 2019 | $125.84 billion |

| 2018 | $110.36 billion |

Source: Statista

20. The top 15 SaaS companies had a $1.4 trillion market cap in 2020

The fifteen leading SaaS companies had an insane $1.4 trillion market cap in 2020 and a revenue of $80 billion. Some of the top brands are Microsoft, Salesforce, SAP, Oracle, Google and WordStream, to name a few.

Source: Tech Times

21. Adobe spent $130 million on Google Ads in 2022

Adobe was the highest spender in Google Ads in 2022, investing a staggering $130 million globally. Second and third were IBM and WordStream, with spending of $85.7 million and $80.4 million.

Source: Statista

22. Zoom experienced a nearly 150% revenue growth between 2019 and 2020

While many companies’ revenues decreased (significantly) because of the COVID-19 pandemic, Zoom’s increased by 148%, going from $90 million in Q1 of 2019 to $225 million in Q1 of 2020.

Then, in Zoom’s fiscal year 2022, the company generated a revenue of $4.1 billion.

Source: Statista #1, Statista #2

23. The average SaaS company has 36K customers

There are SaaS companies of all shapes and sizes, from hundreds to thousands to tens and hundreds of thousands of customers. However, an average SaaS company has 36,000 customers. But the number increases to 85,000 for public SaaS companies that sell primarily to SMBs.

Source: SaaStr

24. Companies with SaaSOps use 2x SaaS tools than non-SaaSOps ones

A company with SaaSOps usually uses twice as many SaaS tools as a non-SaaSOps company. IT professionals are firm believers that SaaSOps is the future of tech and will continue to grow.

Source: BetterCloud #2

25. By 2025, 85% of business apps will be SaaS-based

At the time of writing this, companies say that 70% of the business applications they use are SaaS-based, but the percentage is likely to increase to 85% by 2025. The two main reasons for SaaS adoption are increased productivity and reduced cost (besides those mentioned earlier).

Source: BetterCloud #2

26. Companies care about SaaS security, integrations and ease of use the most

After they settle on the SaaS solution that meets their criteria, the main three things a company cares about are security (43%), ease of use (22%) and native integrations (27%).

Source: BetterCloud #2

Challenges Of SaaS Apps Statistics

27. Nearly 30% say that it takes them one day to fix SaaS security misconfiguration

28% of respondents said it takes one day to sort a SaaS security misconfiguration. But 1% of them said it takes them more than half a year to fix this type of misconfiguration. Luckily, such a challenging misconfiguration happens very rarely.

Source: Statista

28. 49% find controlling application sprawl the most challenging in managing SaaS apps

A survey was done asking IT leaders of organizations with 500+ employees to name the biggest challenges when it comes to managing SaaS applications. Here are the results:

| Challenge managing SaaS apps | Share of respondents |

| Controlling application sprawl | 49% |

| Discovering unmanaged applications | 26% |

| Minimizing unmanaged spend | 14% |

| Providing guardrails and governance | 11% |

Source: Statista

29. 22% of SaaS security incidents are due to former employees’ access

Insider threats in organizations using SaaS applications are more serious than you think. The employees who retain access to the organization’s SaaS apps account for more than 20% of security incidents.

This shows how important it is to delete all ex-employee accounts to avoid inconvenience, which can lead to unnecessary spending of time and money.

Source: Security Boulevard

30. Offboarding can take 7+ hours without automation

Depending on the company size, it can take anywhere from three hours to seven and a half hours to offboard one user/employee. But a company that uses a SaaSOps platform to automate the offboarding workflow can significantly reduce the time needed to complete this journey.

As you can see from the table below, it can only take a few minutes.

| Company size (nr. of employees) | Without automation | With automation |

| 0-199 | 3 hours | 12 minutes |

| 200-499 | 7 hours, 30 minutes | 1 hour, 10 minutes |

| 500+ | 5 hours, 20 minutes | 38 minutes |

Source: BetterCloud #2

31. 35% say SaaS misconfigurations happen due to too many departments with access

The number one reason for SaaS misconfigurations leading to security incidents is that too many departments can access the security configurations. And the second most common cause is a lack of visibility when security settings change.

| Reasons for SaaS misconfigurations | Share of respondents |

| Too many departments with access to security settings | 35% |

| Lack of visibility when security settings change | 34% |

| Lack of SaaS security knowledge | 22% |

| Misappropriated user permissions | 8% |

Source: Adaptive Shield

Other SaaS Statistics

32. 73% say SaaS is the biggest player in achieving business goals

In a study on technology, 73% of organizations said that SaaS is the most important in realizing their business goals. Of those 73%, 38% said it is “very important,” and 35% said it is “quite important.”

The other most important technologies are big data (72%), artificial intelligence (52%) and robotic process automation (46%).

Source: Harvey Nash Group

33. Salesforce has nearly 80,000 employees

In 2023, Salesforce is employing a whopping 79,390 employees, which is a 7.95% increase from 2022.

The company had 73,541 employees in 2021, 56,606 in 2020 and 49,000 in 2019 (a 40% increase since 2018).

Source: Macrotrends

34. Business-critical SaaS applications are seeing the biggest investments

More than 80% of organizations are increasing their investment in business-critical SaaS applications. Investments in security tools for the SaaS stack and staff for SaaS security are seeing lower increases, at 73% and 55%.

Source: Adaptive Shield

35. Only 14% of organizations monitor their SaaS security settings daily

If not checking SaaS security configurations regularly, organizations are at a higher risk of misconfigurations, making them more vulnerable.

| Frequency | Share of organizations |

| Yearly | 13% |

| Quarterly | 15% |

| Monthly | 18% |

| Weekly | 24% |

| Daily | 14% |

| Continuously | 10% |

| Don’t check | 5% |

Source: Adaptive Shield

36. Sales-negotiated pricing is the most popular pricing model in B2B SaaS companies

44% of companies’ approach to pricing is sales-negotiated, followed by fixed pricing (34%) and variable pricing (24%). But 64% of companies said they expect to expand into new pricing models, more focusing on variable pricing models.

Source: Maxio

37. 42% of Saas companies promote monthly and annual subscriptions

While more than 40% promote both pricing options, 26% of companies offer only monthly and 18% only yearly pricing models.

Moreover, 82% list actual prices, 40% offer a yearly discount and 48% have an option of a free plan. When it comes to subscription plans, 42% mention add-ons, 36% highlight the most popular plan and 4% include a form that suggests the best-fitting plan.

Source: FastSpring

38. Increased user retention by 5% can boost profits from 25%-95%

Everyone knows acquiring new users is much more complicated than retaining new ones.

And when you know that increasing user retention by 5% can improve your profits from 25% to 95%, you want to work on building even stronger relationships with existing customers.

Source: Future Of SaaS

39. 65% of companies use customer success to upsell customers

The number one upsell technique SaaS companies use to upsell customers is customer success. The other two popular models are demos, trials and open tests and direct communication.

Source: RiverSaaSCapital

Conclusion

SaaS has grown into a multi-billion-dollar industry with no signs of slowing down. Hey, we all benefit from SaaS in one way or another.

It saves costs, time and ensures flexibility and scalability, which those without using modern technology are hard to compete with.

As we’ve seen from the statistics, the SaaS market is expected to grow even more in the coming years as more companies focus on integrating modern tech (like artificial intelligence, machine learning, etc.).

By staying up-to-date through these SaaS statistics, businesses around the world can stay ahead of the curve and remain competitive in the fast-paced world of technology.

It just may be that without SaaS, you may be left (far) behind.

Was this article helpful?

YesNo